If anyone had any doubts about the strength of the relationship between the price of oil and the BP (LSE:BP.) share price, then the events of the past few days should help clarify matters.

Since close of business on 2 April — just before President Trump’s ‘Liberation Day’ speech — a barrel of Brent crude was selling for $74.95. A week later, after five successive days of falls, it’s down to $59.15. That’s a drop of 21.1%.

| Date | Brent crude ($ per barrel) | Change (%) |

|---|---|---|

| 3 April | 70.14 | -6.4 |

| 4 April | 65.58 | -6.5 |

| 7 April | 64.21 | -2.1 |

| 8 April | 62.82 | -2.2 |

| 9 April (lunchtime) | 59.15 | -5.8 |

Over the same period, BP’s stock has fallen 23%. This isn’t a surprise to me given that around 65% of the group’s revenues are derived from the sale of oil-based products.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

But I fear there may be further falls ahead. The last time oil prices were at this level was in February 2021. At the time, BP’s shares were changing hands for less than £3. And the current uncertainty on the impact of tariffs on the global economy could make things even worse.

Taking a long-term view

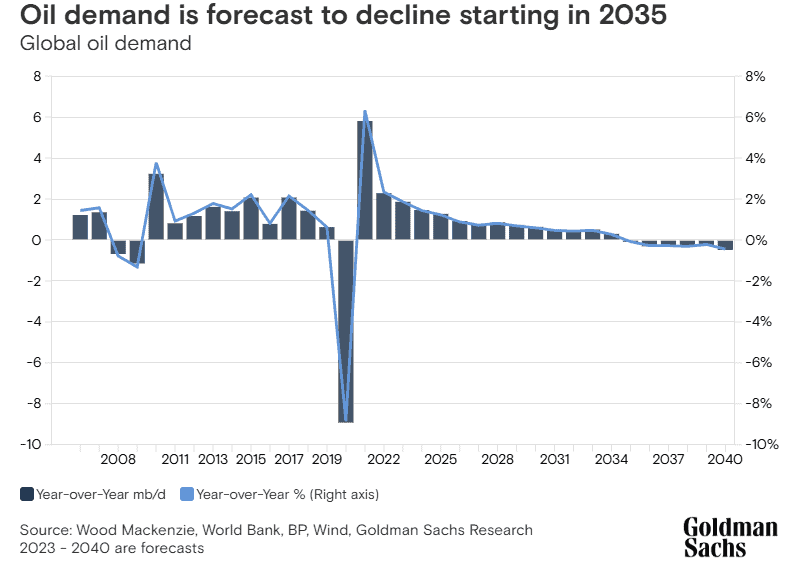

However, most economists are expecting the demand for oil to continue to rise over the next few years. For example, Goldman Sachs is forecasting ‘peak oil’ to occur in 2034. And as the chart below shows, there will only be a small reduction in demand thereafter.

The investment bank’s also produced an alternative scenario in which the adoption of electric vehicles (EVs) is slower than currently anticipated. This model shows oil demand continuing to rise until 2040.

And this could be the path we’re on. The UK government’s recently announced plans to allow smaller volume car manufacturers to continue to produce petrol cars beyond the current deadline of 2035.

The recent fall in BP’s share price has also created an opportunity for income investors.

Based on its last four quarterly dividends, the stock’s now yielding an impressive 7.3%. In April 2024, the return was a less generous 4.2%. Of course, much of this has been caused by the fall in its share price — it’s down 34% over the past 12 months — but unless the oil price remains depressed for a sustained period, I think the energy giant’s dividend is safe for now.

What I’m thinking

Despite these positives, I’m aware of the risks of investing in the energy sector. Volatile oil and gas prices mean it’s impossible to accurately predict BP’s earnings from one year to the next. And a fall in profit could have an impact on the dividend.

Also, the Deepwater Horizon disaster shows how dangerous the industry can be. The tragedy resulted in 11 deaths and cost the group over $65bn in clean-up costs, fines and compensation.

But after weighing up the pros and cons, I’m seriously considering putting the stock into my Self-Invested Personal Pension (SIPP).

However, although investing for retirement requires taking a long-term view, I’m going to wait a little longer before making a final decision. I don’t think the current market volatility will end soon, which makes me reluctant to invest right now. In the mean time, I’m going to keep BP on my watchlist.